The minimum amount of car insurance policy essential to meet your requirements relies on several variables, including what state you stay in, the worth of your car and. There are several sorts of insurance you may require to protect yourself monetarily, yet exactly how much automobile insurance coverage is suggested? You ought to bring the highest possible quantity of responsibility coverage you can manage, with 100/300/100 being the best insurance coverage degree for many chauffeurs.

Each state has minimum insurance coverage requirements, yet many states call for much less insurance than you require to protect on your own as well as your properties. Contrast Insurance Rates, Guarantee you are obtaining the best rate for your insurance get more info policy. How Much Car Insurance Coverage Coverage Do You Need?

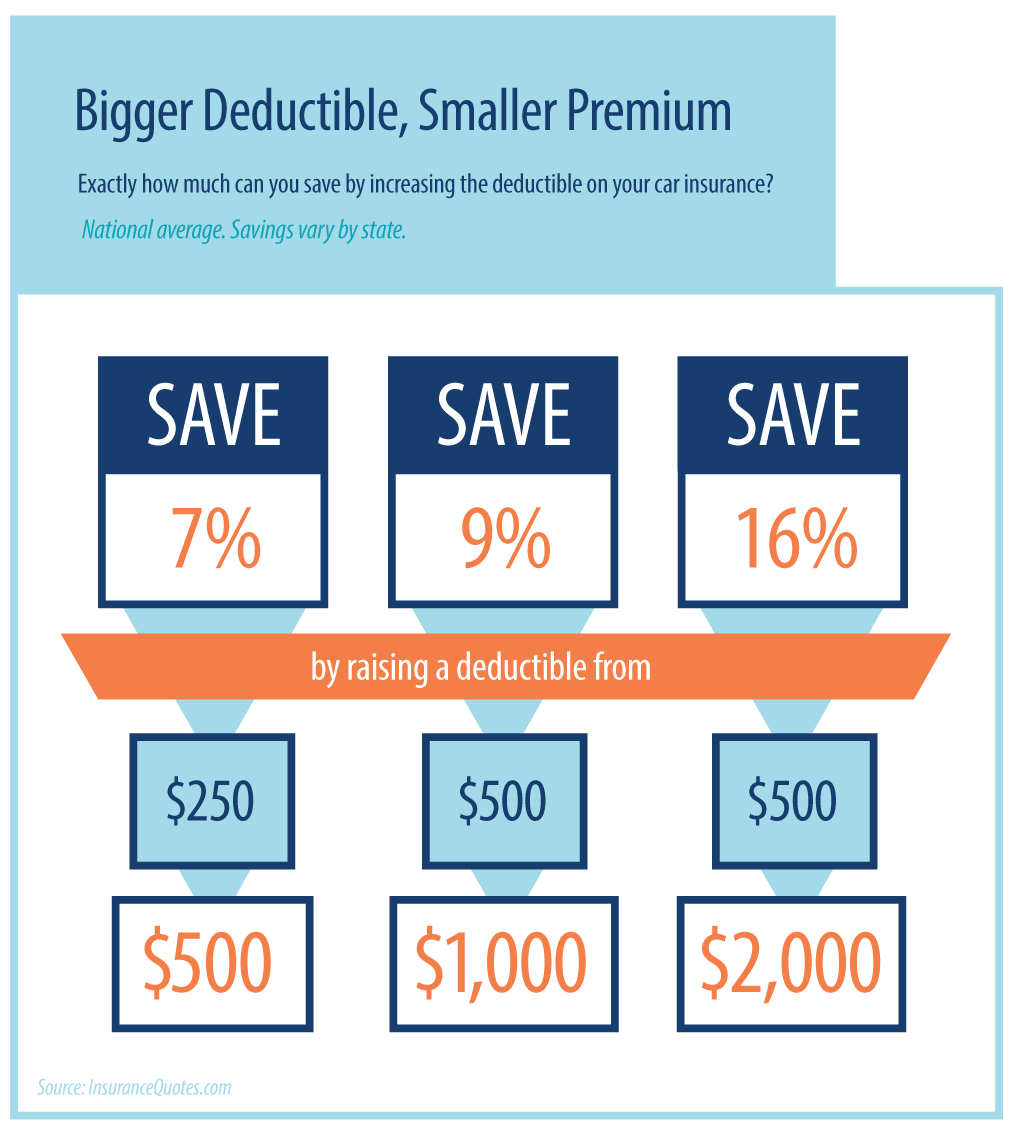

What States Require Added PIP and also Insurance Coverage? There are many numerous kinds car auto coverage available, including: Umbrella Policy: If you don't think believe the highest levels degrees bodily injury and property residential property damages responsibility would certainly enough sufficient protect safeguard assets possessions a severe accidentMishap you might could to purchase acquire umbrella policyPlan Commonly, you can pick anywhere from $100 to $1,000 as your deductible quantity: the greater your deductible, the reduced your month-to-month insurance coverage costs.

Does It Ever Make Good Sense to Have Liability-Only Insurance coverage? There are some circumstances where just carrying liability insurance coverage makes good sense (insurance companies). Some states have much higher minimal protection degrees than others, and sometimes also require you to bring added protections such as personal injury defense (PIP)as well as without insurance driver coverage( UM). Contrast Auto Insurance Coverage Fees, Ensure you are obtaining the very best price for your car insurance. Compare quotes from the top insurance provider. These are example prices as well as need to only be made use of for relative objectives. Rates were determined by assessing our 2021 base account with the ages 18-60 (base: 40 years )applied. Relying on age, motorists may be an occupant or property owner. Prices for 18-year-old are based on a motorist of this age that is an occupant(not a homeowner)and also by themselves policy. Washington State presently permits credit history as a rating element, but a ban on its usage is currently on hold in the courts. With the rising expenses of healthcare and also automobile components, though, these minimum obligation restrictions are typically inadequate. To choose just how much obligation insurance you require, start by asking on your own the.

adhering to concerns: The danger of car crashes is higher among 16- to 19-year-olds than any kind of various other age. The more assets you have(house, financial savings, financial investments, etc), the much more you need to lose. Know whether your insurance company provides split restriction or solitary limit plans. The plan kind will certainly establish just how much coverage you have if you are accountable for an accident. Learn a lot more about NJM Auto Insurance Policy, or discover various other vehicle insurance subjects in Ask NJM.

Getting The Louisiana Office Of Motor Vehicles: Home To Work

You're concerning to move: Where you live is an important consider establishing your rates. Your credit history have transformed considerably: Cars and truck insurer with the exception of those in California, Hawaii, Maryland and also Massachusetts consider your credit when setting your price. Your motoring background has actually enhanced: If it's been awhile given that your lastmishap or driving violation, your price might enhance. credit.

Your driving regimen has transformed: If you're driving less miles nowadays or no longer travelling for work, you might want to shop around to see if you can get a reduced price. Your insurance deductible is the amount you need to pay prior to the insurance policy business pays for a protected loss. Not all types of vehicle insurance policy protection have actually a deductible affixed to them. If you acquire protection that has an insurance deductible, the quantity you choose can affect your premium. Generally, policies with greater deductibles set you back much less than policies with lower deductibles. When assessing coverage, it is necessary to make certain you're comparing plans that have the very same limits as well as deductibles (insurance affordable). Otherwise, you're not comparing apples to apples. To obtain an exact quote, you require to give some details concerning you and also your automobile, consisting of: The chauffeur's license varieties of everyone on the policy Year, make, and model of your vehicle Lorry recognition number(VIN) of your automobile Variety of miles you anticipate to drive annually The ideal means to.

discover one of the most cost effective plan is by looking around as well as comparing quotes in between insurers. If vehicle isn't the only type of insurance you require, you may be able to conserve with a multi-policy discount by purchasing even more than one sort of coverage from the exact same insurance company. auto insurance. Guaranteeing all your vehicles with one company may aid decrease your premium. Safe motorists conserve insurer money. The automobile model you pick can influence your insurance costs. When you locate an auto you enjoy, make sure to run the numbers as well as see if it is right for you. If you can not afford the insurance premiums, you might

require to find an additional automobile. It is feasible to buy more insurance coverage defense than the minimal level of protection needed. Responsibility insurance policy coverage safeguards you only if you are responsible for a crash and also spends for the injuries to others or damages to their home. It does not provide insurance coverage for you, your guests that are your resident loved ones, or your home. What other kinds of coverage can I purchase? Motorists that wish to protect their vehicles against physical damage can need to buy: This coverage is for damages to your automobile resulting from a crash, no matter that is at mistake. It attends to repair of the damage to your automobile or a financial settlement to compensate you for your loss.-This spends for treating injuries to you as well as your passengers without regard to fault. It likewise spends for treating injuries arising from being struck as a pedestrian by an automobile . What is an insurance deductible? Your vehicle insurance policy deductible is the amount of cash you should pay out-of-pocket before your insurance coverage compensates you. You have a Subaru Outback that has Collision Insurance coverage with a $1,000 deductible. You back end another motorist, as well as your Subaru is damaged. You take it to the body shop as well as the overall cost to fix all the damages is$6,500 - affordable.

In this situation, you would certainly pay the body store$ 1,000. As soon as you have actually satisfied your$1,000 deductible the insurer will certainly pay the staying $5,500. Just how does my deductible impact the cost of my insurance? Usually, the lower your deductible, the higher the cost of your insurance coverage will certainly be. The higher your insurance deductible is, the lower the cost of your insurance coverage will certainly be.

A Biased View of Florida Insurance Requirements

How do I buy car insurance coverage? When buying insurance, the Department of Insurance advises that you look for the recommendations of a professional insurance professional. There are three kinds of specialists that typically offer insurance: Independent agents: can sell insurance coverage from multiple unaffiliated insurance companies. affordable.

Special agents: can just offer insurance from the firm or team of business with which they are connected. Despite what type of expert you pick to utilize, it is very important to verify that they are licensed to carry out service in the State of Nevada. You can examine the certificate of an insurance coverage professional or business right here. Bear in mind Constantly validate that an insurance business or agent are licensed before providing them personal information or repayment. These aspects include, but are not restricted to: Driving document Claims history Where you live Sex and also age Marriage Standing Make as well as design of your lorry Credit scores Nevada has among one of the most competitive as well as healthy and balanced automobile insurance policy markets in the country.

liability vehicle car insurance credit

liability vehicle car insurance credit

To learn regarding the use of your credit report details by insurance coverage firms review our Regularly Asked Inquiries Regarding Credit-Based Insurance Policy Scores. While each state has its own standards on exactly how much vehicle insurance policy coverage you need require buyGet there are other various other to considerThink about Optional insurance coverage, State-mandated insurance protection is the minimum for driving, and generallydoesn't include damage to your car.

Without this type of insurance coverage, you might need to pay of pocket totally if you're struck by a without insurance chauffeur. That noted, some states enable PIP to cover these sorts of losses while others do not, according to Friedlander. You may also intend to consider acquiring full protection insurance coverage(both thorough as well as accident) - insurance. Specifically if you live near a location that obtains major or experiences.

cyclones during the period, adding comprehensive coverage might be a great concept. And also also if you do not live near a flood location on the coast, Friedlander still suggests acquiring thorough coverage, as 90%of all-natural catastrophes involve flooding, indicating you can experience a flooding nearly anywhere in the country. It seems insane to acquire anything without understanding what you're mosting likely to pay for it, but that's what a whole lot of us do when it comes to cars and truck insurance. Numerous people purchase a vehicle initially and also just after that start thinking about cars and truck insurance policy as well as just how much they'll pay. You can discover more information about your state right here at Minimum Demands by States."State minimum"and "Criterion Obligation"plans are normally minimal or low-limit plans, giving simplistic insurance coverage. While these policies have reduced rates, we advise higher limits to guarantee sufficient coverage ought to an accident or vehicle damage occur. This will make you mindful of what your insurance plan costs might be and also permit you to allocate it suitably-- or look for a service provider that supplies a far better cost offered your situation. How to start: Decide just how much automobile insurance coverage you need, The three primary kinds of car insurance coverage you need to comprehend are: Responsibility car insurance coverage, Covers others 'residential or commercial property damages and also clinical costs. However if you own a house or have a whole lot of financial savings 100/300/100 is advised. That means you're covered for$100,000 per person, up to$300,000 a mishap for clinical bills for those hurt in an accident you create, as well as $100,000 for home damages that you create. If you want the most affordable auto insurance coverage possible when contrast buying, look for obligation protection only, as well as in the quantity your state needs for you to lawfully drive. Many states 'minimum liability requirements are so reduced that if you remained in an accident, and it was determined or at least believed to be your fault, you might be at risk to costly suits, which suggests you might wind up losing your home or savings. We're thinking worst-case circumstance and also a really poor legal action, however, still, it's something to think of - auto insurance. Accident protection, Covers damage to your automobile, no matter mistake. If you are in a wreckage you will not have to get a new automobile with absolutely no funds. This pays out approximately the actual cash money value of your auto if it is found to be a failure after a vehicle accident. You might not require extensive and also crash protection if your cars and truck is more than 10 years-old as well as unworthy a lot. Yet, thorough as well as accident insurance coverage are commonly really inexpensive, so it may be wise to carry these optional protections. Determine now what deductible makes sense

for your situation. Among the most effective methods to reduce car insurance coverage expenses is to raise your insurance deductible for crash as well as thorough insurance policy. If you have greater than one case, you'll need to pay the deductible each time. We suggest you select a quantity that you can pay from cost savings. Your auto won't be repaired up until you pay your share. Expert Guidance, Loretta Worters, Vice president,

Insurance Policy Details Institute, Worters states that beyond just responsibility or thorough car insurance coverage, vehicle drivers need to take into consideration obtaining an umbrella plan, which is essentially a fancy term for additional insurance, covering, essentially, every little thing imaginable.

"Umbrella insurance policy can give coverage for injuries, building damages, specific claims, as well as individual obligation circumstances. Exactly how to get exact quotes? Request prices from at the very least three various insurance providers. Make sure to contrast the same automobile insurance policy coverage by using the same responsibility limits, the same deductibles as well as optional insurance coverages. Professional's Idea, When making these contrasts, Yoswick recommends that you maintain an open mind as well as"don't limit your (risks).

6 Simple Techniques For Car Insurance Rates By Make And Model 2022 - Finder.com

cheaper cars risks cheap auto insurance low cost

cheaper cars risks cheap auto insurance low cost

search simply to the biggest insurance companies with the best-known brand. Nevertheless, the amount state-mandated liability insurance policy pays for crashes may not suffice to cover the expenditures, leaving you to pay the distinction. Expert Guidance, Mark Friedlander, Supervisor of business communications for the Insurance Information Institute" Opportunities are that you will certainly need much more liability insurance coverage than the state needs because accidents set you back even more than the minimum limitations, "observes Mark Friedlander. For those reasons, you might intend to raise your protection to higher physical injury liability restrictions and also higher building damage liability limitations:$ 100,000 per individual, approximately$300,000 a crash for medical expenses for those harmed in a mishap you create, and$ 100,000 for home damage that you trigger. For cost-conscious consumers with older vehicles, it might not deserve the cash to guarantee against damages to your automobile. If your auto deserves less than 10 times the costs that you are paying for these extra insurance coverages, acquiring these protections may not be affordable.

" Just how do I lower vehicle insurance rates? Think about complying with these suggestions to reduce the cost of auto insurance coverage without compromising protection.

Check safety scores and also purchase a vehicle that's considered safe by insurer. Has showed up frequently on Good Morning America looks, Buying car insurance coverage resembles shopping for anything else. You need to always compare costs,"Bodge says. cheapest."There are numerous carriers out there, and while they commonly think about factors like your age, driving history, kind of auto, etc, rates can vary widely from service provider to provider (car insurance)."" Once you settle

on a car insurance policy service provider, this is not your service provider for life. Case in point, my partner and also I were with the very same carrier for years. We thought that we were obtaining the very best rate, like we were when we initially subscribed, yet once we searched, we understood we can do a whole lot better. Also, if your credit rating improves over time, you can certify for an extra favorable car insurance rate".

The 6-Minute Rule for Why Is My Car Insurance So High? - J.d. Power

When obtaining real quotes from insurance policy firms, you'll usually have to provide at the very least the following: Your permit number, Lorry recognition number, Your address, or where the auto is maintained when not on the roadway, Regularly asked questions while approximating vehicle insurance policy costs, You've obtained more inquiries? When contrasting auto insurance policy prices, it's crucial to look at the price, make sure the protections match with every quote so you are comparing apples to apples, and and also a look at the insurance insurance coverageFirm reputationOnline reputation"Mckenzie saysClaims